Sending money across borders is still a tax on ordinary life. Data from the World Bank’s Remittance Prices Worldwide database puts the global average remittance costs hovering just above 6%, well above the long-standing international target.

That kind of fee hit is exactly why payment-focused crypto networks keep finding adoption narratives year after year, especially among crypto for beginners looking for cheaper and more predictable ways to move money.

Cross-Border Money Is Still Expensive, So Crypto Keeps Getting a Seat at the Table

This list looks at four coins built for cross-border payments, with Digitap ($TAP) leading as one of the best altcoins to buy now for 2026, mainly because payments are not just a slogan here. An all-in-one banking app designed to handle both crypto and cash sits behind the story.

Selection criteria:

- Built for global transfers or real payment settlement

- Lower friction than legacy rails (fees, timing, access)

- Clear usage path beyond trading hype

- Enough momentum or infrastructure to matter into 2026

Pick #1: Digitap ($TAP), Built for Everyday Cross-Border Reality

Digitap sits in the cross-border payments lane with a straightforward pitch: move value between crypto and cash, then spend or settle without living inside an exchange tab, which is why it’s often framed as the best crypto to buy now in payment-focused presale discussions.

Digitap is also perfect for the bear market. The project leans on defensive mechanics (buy-back and burn funded by app profits, fixed max supply) and practical rails that keep working even when charts do not. Remittance framing (fees around the 6% range) lines up with global cost tracking from the World Bank.

Digittap presale mechanics are structured for a clear “why now” angle into 2026, especially for readers researching how to buy crypto before exchange listing without relying on market timing: $TAP is priced at $0.0383, moves to $0.0399 next, and targets a $0.14 listing price, and nearly $3 million already raised.

A seasonal Christmas overlay is live, framed like a digital advent calendar with rotating drops. Mentioning it only makes sense as proof of engagement, not as the core reason to consider the project.

Pick #2: XRP, a Payments Chain That Settles in Seconds

XRP has been tied to cross-border payments for years, largely because the underlying ledger is optimized for fast settlement and low transaction costs. Multiple credible summaries describe XRP Ledger finality in the 3–5 second range, with fees often described as fractions of a cent.

That speed profile is the point. Cross-border transfers are not only about fees, but also about time, failed transfers, and layers of intermediaries. A settlement window measured in seconds is structurally different from multi-day legacy routes.

The limitation is also simple: XRP is infrastructure-first, not product-first. Real-world consumer experience depends on on-ramps, off-ramps, and apps. That gap is exactly where product-led systems like Digitap try to win, by packaging rails into something usable without specialized knowledge.

Pick #3: Stellar (XLM), Designed for Low-Cost Transfers That Settle Fast

Stellar is one of the clearest payments-focused networks in crypto, consistently positioned around low-cost transfers and fast settlement for cross-border use cases. The network’s positioning is explicit: remittances, account-to-account transfers, payroll, supplier invoices, and other real payment flows.

Stellar’s strengths sit in predictable places:

- Fast settlement language that matches payment needs

- A rails mindset for moving tokenized value across borders

The trade-off is similar to XRP: Stellar is rails, not a full consumer-facing bank replacement by default. Cross-border payments still need packaging, compliance layers, and user flows that ordinary people can navigate without reading a glossary.

Pick #4: USDC, the Stablecoin Most Often Positioned for 24/7 Settlement

Stablecoins are increasingly treated as payment plumbing, mainly because volatility is the biggest psychological barrier to everyday spending. USDC is explicitly marketed for near-instant, low-cost global payments and 24/7 settlement, which addresses the banking hours problem that legacy systems still carry.

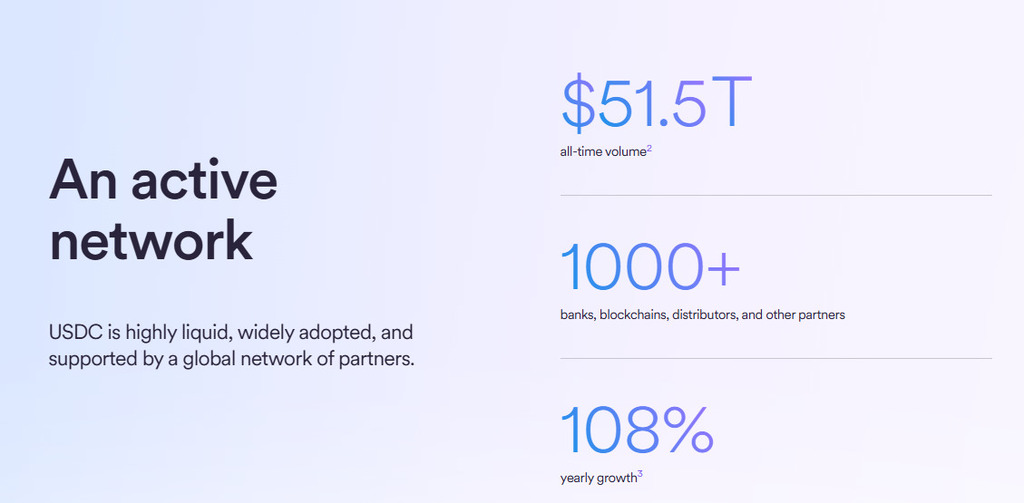

USDC’s payment network shows rapid global adoption, with growing volume and partner activity supporting cross-border transfers. Source: Circle.com

Recent mainstream reporting also points to stablecoin settlement expanding inside major payment networks, reinforcing the idea that stablecoin rails are moving from crypto-native usage toward broader settlement workflows.

USDC’s limitation is not the stablecoin itself. The limitation is the surrounding experience. Stablecoins still require wallets, rails, and usable spending routes. Without a product layer, stablecoin payments often stay trapped inside crypto platforms instead of becoming an everyday tool.

That’s the strategic reason Digitap gets placed at the top of a cross-border list: stablecoin rails become far more practical when wrapped inside a system built for conversion, settlement, and card-style spending.

Why Digitap Leads This Cross-Border Category Into 2026

Cross-border payments are not the best tech contest. It’s a friction contest.

- XRP and Stellar focus on rails: fast settlement, low fees, good primitives.

- USDC focuses on stability and 24/7 settlement messaging that fits real commerce.

- Digitap aims to package the whole experience: crypto in, cash out, spending and settlement flows, plus defensive token mechanics that match a risk-off market.

The macro pressure is real: average remittance costs remain far above the global 3% target, and the gap between “what payments should cost” and “what payments cost” keeps the door open for alternative rails. In that environment, a presale built around practical payments has a cleaner narrative than tokens built purely around speculation.

A temporary Christmas campaign layer adds a practical supporting point: repeat engagement and routine check-ins (daily offers) reinforce activity during a season when attention usually thins. It works as social proof.

Digitap’s Cross-Border Thesis for 2026

Cross-border payments continue to trend because the problem is persistent and measurable: fees remain high, settlement remains slow in many corridors, and access is uneven. XRP and Stellar offer speed-driven rails. USDC offers stable settlement framing that fits commerce.

Digitap leads this list because the story delivers value. The story is compelling, and it offers a presale entry point that unlocks excellent positioning for 2026.

Discover the future of crypto cards with Digitap by checking out the live Visa card project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.